This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Complete Guide to Creating a Church Budget

A Capital-Based Budget focuses on investments and large projects. This type of budget is best suited for a long-term investment in assets like buildings or equipment. Financial planning is a comprehensive strategy that encompasses budgeting while also considering debt management, savings, and investments.

Your Budget Can Show That People Are More Important Than the Budget

- Set clear financial goals that reflect your ministry priorities and strategic objectives.

- When a church puts on an event or conference, there’s sometimes a registration fee the attendee pays for the event.

- If you have any building projects in the pipeline, a capital-based budget might be best.

- Instead, the best approach when planning next year’s budget is to use a tiered system.

- Many people think tithes and offerings are the only income a church receives, but this isn’t entirely true.

It’s not only about the money, but about the whole individual offering back to God of their time, talents, and possessions. This is most effective when how to create a church budget we know and understand that everything we have comes from God as a gift from Him, and that we have been entrusted to care for His resources. Since donations fluctuate from year to year, you will be making an educated guess about this every year and it will be rare that you are exact with your estimate. Always start with studying the previous year and make adjustments for the upcoming year. Also, refer back to your goals to inform decisions on where the money should be allocated for the current year.

Consider Your Financial Goals and Priorities

Plus, you should have some margin in place for unexpected expenses or have retained earnings set aside for emergencies. You also need to have some type of system or governance structure that restricts the use of these funds for times of emergency. Your accounting person will be bringing in a simple financial report of incomethat month and expenses. The budget will list the estimated amount of income or expense the church is forecasting for this year. Under that amount will bethe amount they spent in that area this month as well as a current year-to-date figure. If the budget is adjusted, it’s vital to communicate these changes to the congregation.

Best Worship Conferences for Church Leaders in 2024

- Church budgets are needed to continue the church’s mission and grow to reach a larger community.

- Today, Joshua pastors at New Life Fellowship, a thriving church he helped plant in Cambridge, Ontario, Canada.

- Is your church budget helping or hurting your church’s ministry?

- Therefore, as you manage and maintain your budget month over month, key a journal of everything that changes along the way.

- Your budget is probably the best record of what your church really values.

- As a reminder, mishandling your churches finances can jeopardize your 501(c)3 non-profit status, or even worse, damage your ministry’s reputation.

Then each budget year Accounting Periods and Methods you base the annual income budget on 90% of the previous year’s annual income. This savings can then be used for capital improvements or advanced ministry. Sixth, be sure to thank those who faithfully serve on yourboard or who helped in the budgeting process. Give them a card or if the funds warrant, take them out for Christmas dinner to say that special thanks on behalf of the church. When comparing expense totals, it is normal that some accounts may reach their totals early inthe year. It is my opinion that it is better to be conservative in this area and remainfaithful to your commitments to missionaries.

- Remember, seeking help is a sign of good stewardship, not weakness.

- There is no stress involved, this is merely good planning.

- Use your budget to help your people trust that you love them more than you love their money.

- When making budgeting decisions, the bible includes many verses to show you the way.

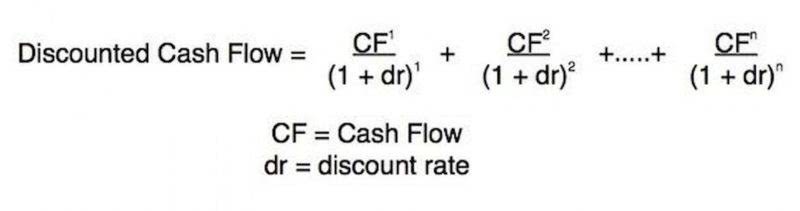

- Take your current net profit for each month and divide it by the total income for that same month.

How To Find And Apply To Grants For Church Repairs

Following a budget also helps hold churches accountable to their congregations and allows them to follow their mission of reaching more people and spreading God’s word. In this article, we share why you need a budget, different types of budgets, some actionable budgeting tips, and a few steps to creating a working budget for your church. Personnel expenses are likely to be your largest budget item. This covers salaries, benefits, and training for church staff and volunteers. Effective allocation involves compensating staff fairly and investing in their professional development to empower them in their ministry roles.

What Types Of Church Budgets Could I Use?

However, having clearly defined financial goals will make decision-making easy. When questions come up about spending, you will be able to see if the expense will help you accomplish your goals or whether it will take away from your goals. One of the first ways you can raise more funds and increase your church’s ministry is by holding events for the public. These events can include a family funfair, a Christmas concert, or a community volunteer day.

Actionable Tips for an Effective Church Budget

— see our article on how to make a stress-free church finance report. Follow these budget best practices to create a robust, adaptable budget that supports your mission and your church’s financial health. As the name implies, this type of budget allocates funds based on specific church programs and ministries. It also helps evaluate the effectiveness of the https://x.com/bookstimeinc program by providing a transparent way to evaluate its impact.

Examining the Current and Future State of the Global Church

A mission-based budget aligns spending with your church’s mission, while a capital budget is useful for managing long-term projects and investments. If you have any building projects in the pipeline, a capital-based budget might be best. This budget lists all expected income and expenses in detailed categories based on the previous year’s budget. This is often the simplest type of budget to prepare, ideal for small—to mid-sized churches. Ensure your budget is balanced – your projected income should cover your estimated church expenses. Be flexible and willing to adjust your budget targets as needed, especially in response to unforeseen circumstances or changes in your church’s financial situation.